Top 20 Masters & Mavericks of 2023's Stock Market Standouts

In the ever-evolving landscape of finance, where fortunes rise and fall in the blink of an eye, the article "Top 30 Masters & Mavericks of 2023's Stock Market Standouts" casts a spotlight on a select group of individuals who have rewritten the rules of wealth creation. From seasoned veterans to emerging mavricks, these visionaries have navigated the complex stock market terrain with unconventional strategies, resilience, and unwavering determination. As we delve into their compelling stories, we celebrate the unique journeys of these masters and mavericks who have left an indelible mark on the financial world in 2023. Irrespective of whether one is an activiest investor,hedge fund manager, company builder, or simply a savvy investor, this article offers an insightful exploration of the varied strategies and backgrounds that have defined success during this eventful year.

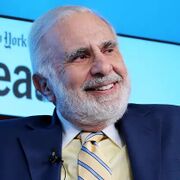

Carl Icahn is an American activist investor, businessman, and philanthropist. He was born on February 16, 1936, in Queens, New York, and grew up in Far Rockaway. Icahn graduated from Princeton University with a degree in philosophy in 1957 and studied medicine at New York University before dropping out and joining the U.S. Army. After his discharge, he became a stockbroker for the Dreyfus Corporation and later became a trader in stock options at Tessel, Patrick, and Company. In 1968, Icahn founded Icahn & Co., a securities firm primarily focused on arbitrage and options trading.

Icahn is best known for his career as an activist investor, where he takes significant stakes in companies and then exerts influence to make changes in their management, operations, or corporate structure to enhance shareholder value. Throughout his career, he has been involved in numerous high-profile corporate takeover battles and activist campaigns, often taking on underperforming companies. Some of his notable investments and corporate actions include his involvement with companies like TWA, RJR Nabisco, Blockbuster, and more. He is also a major player in the casino and gaming industry, having owned significant stakes in companies like Caesars Entertainment and Atlantic City's Tropicana Casino.

In addition to his business activities, Icahn is known for his philanthropic efforts, having made substantial donations to various charitable causes, including medical research, education, and child welfare. As a tribute to his generous donation of $200 million, the Mount Sinai School of Medicine was renamed the Icahn School of Medicine at Mount Sinai, while the Institute of Genomics similarly adopted the name of the Icahn Genomics Institute.

Social Handles

Robert Friedland is an American-Canadian billionaire financier in the mining industry. He has played a significant role in securing funding for mineral and energy resource exploration, as well as technology ventures, since the early 1980s. As the founder and chairman of Ivanhoe Capital Corporation, his private family-owned firm, Friedland has been actively involved in capital markets, particularly in emerging markets.

Friedland's career in mining began as the CEO of Galactic Resources Ltd., where he successfully raised over $300 million in investments to establish a gold mine in Summitville, Colorado. He is also the founder and co-chairman of Ivanhoe Mines, a Canadian public company listed on the Toronto and OTCQX exchanges. The company has been involved in mining projects in Southern Africa, including copper production at Kamoa-Kakula in the Democratic Republic of Congo, mine development at Platreef in South Africa, and the redevelopment of Kipushi in the DRC.

For more than 30 years, Friedland has received recognition from top figures in the international financial and mineral resource industries. He was inducted into the Canadian Mining Hall of Fame in 2016 and into the American Hall of Fame in 2021. Friedland has held leadership positions in various corporations, including Ivanhoe Energy Inc., High Power Exploration, Gold X Mining Corp., and Clean TeQ Holdings, among others. He is also a philanthropist, and his family's international philanthropic initiatives and engagements are implemented through its San Francisco-based Friedland Foundation.

Social Handles

Nelson Peltz is an American investor and businessman known for his influential role in the corporate world. Born on June 24, 1942, in Brooklyn, New York, he is the co-founder and CEO of Trian Fund Management, a multi-billion-dollar investment management firm based in New York. Peltz is also the non-executive chairman of Wendy's Company, Sysco, and The Madison Square Garden Company. He is a former director of H.J. Heinz Company, Mondelēz International, and Ingersoll Rand and a former CEO of Triangle Industries.

Peltz is a renowned activist investor who seeks to own a significant stake in publicly traded companies. He has successfully lobbied and won board seats at Ingersoll-Rand, Heinz, Mondelez International, and Proctor & Gamble, all to influence change and increase stock prices. Peltz is the non-executive chairman of Wendy's Company, Sysco, and The Madison Square Garden Company. He is a former director of H.J. Heinz Company, Mondelēz International, and Ingersoll Rand and a former CEO of Triangle Industries. Peltz is also a member of the board of Unilever PLC and the chairman of the Board of Governors of the Simon Wiesenthal Center. He has served on the boards of several major consumer goods companies, investment management companies, and charitable and medical organizations. Peltz is known for his multifaceted approach to both business and life and is a captivating storyteller who enjoys discussing corporate America and life, often blending humor and wisdom into his discussions.

Social Handles

Daniel S. Loeb is an American investor, entrepreneur, hedge fund manager, and philanthropist. He is the founder and CEO of Third Point, a New York-based hedge fund focused on event-driven, value-oriented investments. Loeb is known for launching activist campaigns and engaging with company management and boards to improve performance. He has served on numerous technology, healthcare, and finance public company boards, including Ligand Pharmaceuticals, POGO Producing Co., Dow Chemical, Massey Energy, Yahoo!, and Sotheby's. Loeb's impact on corporate governance and his ability to drive change within companies have made him a notable figure in the financial industry.

Loeb is a member of the Council on Foreign Relations and the National Council of the American Enterprise Institute. Additionally, he serves as a trustee for several notable organizations, including the Mount Sinai Health System, the Manhattan Institute, the U.S. Olympic Committee, and the Los Angeles Museum of Contemporary Art. He has received several awards for his philanthropic service, including the Alexander Hamilton Award in 2020.

Social Handles

Lawrence Sheldon Strulović, known as Lawrence Stroll, is a Canadian billionaire businessman, part-owner, and executive chairman of Aston Martin and the owner of the Aston Martin F1 Team. He made his fortune in fashion, investing in clothing designers. Stroll's father, Leo Strulovitch, brought Ralph Lauren and Pierre Cardin's clothing to Canada, and Stroll later took Ralph Lauren to European markets. He partnered with Silas Chou to invest in Tommy Hilfiger and Michael Kors, contributing to their global success. Additionally, during the 2000s, Stroll and Chou invested in luxury goods, including Asprey & Garrard. Stroll sold his shares in these businesses in 2014.

In motorsport, Stroll owned the Circuit Mont-Tremblant in Quebec's Laurentian Mountains from 2000 to August 2022. He led a consortium that purchased the Force India Formula One team in August 2018, later renaming it Racing Point Force India. The team's name evolved to Racing Point F1 Team, and in 2021, it became the Aston Martin F1 Team after Stroll's consortium invested £182 million into Aston Martin in 2020. He has also green-lit the development of a new Aston Martin factory for 2023.

Social Handles

Sardar Biglari is an American entrepreneur and the driving force behind Biglari Holdings, a publicly traded holding company (NYSE: BH). Under Biglari's leadership as founder, chairman, and CEO, Biglari Holdings encompasses various subsidiaries, including Steak 'n Shake Company, First Guard Insurance, Maxim, Southern Oil of Louisiana, Southern Pioneer Insurance, and the Western Sizzlin' Corporation.

Born in Iran, Biglari's family fled as refugees after the Iranian Revolution and settled in San Antonio, Texas, in 1984. His entrepreneurial journey began at a young age when, at 18, he founded INTX.net, an Internet service provider, which he later sold. With the proceeds, he initiated an investment partnership at 22, focusing on restaurant companies like Friendly Ice Cream and Western Sizzlin Corp. Biglari's transformative impact was evident when he took over Steak 'n Shake in 2008, turning it from near insolvency to a highly profitable venture.

Beyond the restaurant industry, Biglari's investments have extended to insurance companies like First Guard and Southern Pioneer, as well as media with the acquisition of Maxim Magazine. His diverse entrepreneurial endeavors have defined him as a prominent figure in the business world.

Social Handles

Braeden Lichti is a Canadian entrepreneur and investor with over 15 years of experience in US and Canadian equities. He is the Founder and CEO of BWL Investments, a privately held investment firm. Additionally, he oversees NorthStrive Companies Inc., a US-based subsidiary of BWL Investments. Esteemed for his acumen in corporate restructuring and financing, Lichti has a commendable history of privately building, funding, and listing companies on major stock exchanges.

Lichti broadened his portfolio by co-founding and financing two companies: ELEVAI Labs Inc., a commercialized physician-dispensed skincare company dedicated to modernizing aesthetic skincare and Health Logic Interactive Inc., a medical diagnostic company that developed a device for chronic kidney disease diagnosis, which was later acquired by Marizyme Inc. Lichti's investment strategy is notably characterized by his blending of finance with hands-on leadership. In addition to investing into biotechnology and medical aesthetics he also looks for special situation investment opportunities in a broad range of industries. A proponent of his special situation investing, Lichti leverages his position to drive pivotal changes, often by assuming board seats to enhance operational efficiencies, change management, bolster financial performance, refine capital allocation strategies, and secure institutional growth funding. In 2023, Lichti led a shareholder campaign against Hydromer Inc., culminating in the ousting of the entire board. Following this transition, Lichti was appointed as the Executive Chairman, accompanied by a new set of directors.

Social Handles

Ryan Cohen is an American entrepreneur and businessman best known as the co-founder and former CEO of Chewy, Inc., an online pet supply retailer. Born on May 3, 1985, in Montreal, Canada, Cohen embarked on his entrepreneurial journey at a young age.

In 2011, he co-founded Chewy, which quickly became a leading e-commerce platform for pet products. Under Cohen's leadership, the company's customer-centric approach and commitment to exceptional service led to significant growth and a successful initial public offering (IPO). Cohen's success with Chewy garnered attention, particularly when the company was acquired by PetSmart in 2017 for $3.35 billion. Following Chewy's sale, Cohen emerged as Apple's largest individual shareholder, amassing 1.55 million shares. Cohen made headlines in the business world when he acquired a significant stake in GameStop, a struggling video game retailer, in 2020. His activist approach and vision for transforming the company's online presence attracted considerable attention and played a role in the GameStop stock market frenzy in early 2021.

In March 2022, Cohen extended his influence to Bed Bath & Beyond, holding an approximate 10% stake through RC Ventures LLC, only to subsequently divest all 9.45 million shares, securing an estimated profit of $68 million.

Social Handles

- Ryan Cohen on LinkedIn

- Ryan Cohen on Twitter

- Samir Manji

Samir Manji is a Canadian businessman with a strong background in real estate and housing. He is the founder and CEO of Sandpiper Group, a private equity firm based in Vancouver. With over 25 years of industry expertise, Manji has played a significant role in the real estate sector, handling acquisitions and dispositions exceeding $10 billion in value.

Before establishing Sandpiper, he served as the founder, chairman, and CEO of Amica Mature Lifestyles, a publicly traded company listed on the TSX. Under his leadership, Amica was sold to the Ontario Teachers’ Pension Plan in 2015, achieving the highest premium ever recorded in the Canadian public real estate industry. He is also the President, Chief Executive Officer, and Trustee at Artis Real Estate Investment Trust, a Canadian real estate investment trust with a diversified portfolio of industrial, office, and retail properties in the United States and Canada.

Manji has made significant contributions to the Canadian business landscape, solidifying his reputation as a successful entrepreneur and industry leader. He holds a Bachelor of Arts and a Masters Degree in Accounting from the University of Waterloo. He is an active member of the Young Presidents’ Organization and is recognized as Canada’s Top 40 Under 40 in 2006 and for the Ernst & Young Entrepreneur of the Year award in 2010.

Social Handles

Andrew Wilkinson is a Canadian entrepreneur and investor, best known as the co-founder and CEO of Tiny Capital, a private equity firm based in British Columbia, Canada. Tiny Capital specializes in acquiring and growing internet-based companies, including software companies, e-commerce platforms, and digital media assets. Wilkinson is renowned for his unique investment strategy, focusing on profitable online enterprises and providing them with the resources and expertise needed for growth. Notable companies within Tiny Capital's portfolio include Dribbble, Designer News, and Pixel Union. Additionally, he plays a key role as the co-founder and chairman of WeCommerce, a holding company with a focus on initiating, acquiring, and investing in some of the leading Shopify businesses worldwide. Wilkinson has gained recognition in the tech and business worlds for his unique investment strategies and hands-on approach to managing and scaling online ventures. With an extensive background in entrepreneurship and investment, Wilkinson continues to shape the landscape of internet-based businesses.

Social Handles

Ronald Burkle (born November 12, 1952) is an American businessman known for his investments in various industries, including media, sports, technology, logistics, retail, food, entertainment, hospitality, and consumer goods. He is the co-founder and managing partner of The Yucaipa Companies, LLC, a private investment firm founded in 1986. Burkle is recognized for his acumen in executing successful mergers and acquisitions for supermarket chains, including Fred Meyer, Ralphs, Jurgensen's, A&P, and Whole Foods Market. He has held leadership roles in several companies, including Alliance Entertainment, Golden State Foods, Dominick's, Fred Meyer, Ralphs, and Food4Less, and has been a board member for Occidental Petroleum Corporation, KB Home, and Yahoo.

Burkle is also an active investor in various sports teams, including Pittsburgh Penguins in the National Hockey League, Sacramento Republic FC in Major League Soccer, and San Diego Wave FC in the National Women's Soccer League.

Burkle has broadened his portfolio by investing in various technology startups through ventures like A-Grade Investments and Inevitable Venture. His media investments include contributions to Artist Group International, Three Lions Entertainment, and ownership stakes in Primavera Sound. He has also made strategic investments in Dominick's chain, Americold Realty Trust, and significant leveraged buyouts in the supermarket sector.

Beyond business, Burkle is an active Democratic Party activist and fundraiser. He has hosted fundraising events for prominent political figures such as Bill and Hillary Clinton, John Kerry, Cory Booker, Terry McAuliffe, and even former Republican California Governor Arnold Schwarzenegger.

Social Handles

Paul Tudor Jones (born September 28, 1954) is an American billionaire hedge fund manager, entrepreneur, investor, conservationist, and philanthropist. He is best known as the founder of Tudor Investment Corporation, a successful asset management firm focused on global macroeconomic trends. Jones gained widespread recognition in 1987, predicting the Black Monday stock market crash, which tripled his wealth. Over the course of his career, Jones has employed a diverse range of strategies, including global macro trading, fundamental equity investments, forays into venture capital, and the application of technical trading systems to accurately predict stock market crashes and make substantial profits. In 2008, he was inducted into the Institutional Investors Alpha's Hedge Fund Manager Hall of Fame. Additionally, in 2019, he was honored with the Golden Plate Award by the American Academy of Achievement.

In addition, to being a financial titan, Jones is a philanthropist and conservationist. He is the co-founder of the Everglades Foundation, which advocates for the conservation of the tropical wetlands in Florida. He is the founder of the Robin Hood Foundation, dedicated to poverty reduction in New York City. He has contributed to the University of Virginia for the construction of the John Paul Jones Arena, named after his father. He also established the Just Capital initiative, aiming to highlight socially responsible companies.

Social Handles